What are payment terms? How to use invoice payment terms to protect your business?

Knowing how to send an invoice appropriately is essential as a self-employed freelancer or small business owner. Payments made on time keep cash flowing, and money in hand is worth more now than it will be later.

According to QuickBooks, small company owners in the United States had an average of $78,355 in outstanding receivables in 2019. In order to ensure that your clients pay you on time, you must provide a good invoice. Understanding popular payment phrases and how to utilize them will assist ensure that your clients pay you on time.

Let’s take a look at some of the most frequent payment terms and how they may help your small business.

What are invoice payment terms?

Payment conditions specify how, when, and how your customers or clients make payments to your company. Invoice payments are frequently related to payment periods. They’re contracts that spell out your payment expectations, such as when the customer must pay you and the consequences of missing a payment. Transparent payment conditions can help you get paid and make your invoicing process easier to comprehend for your consumers.

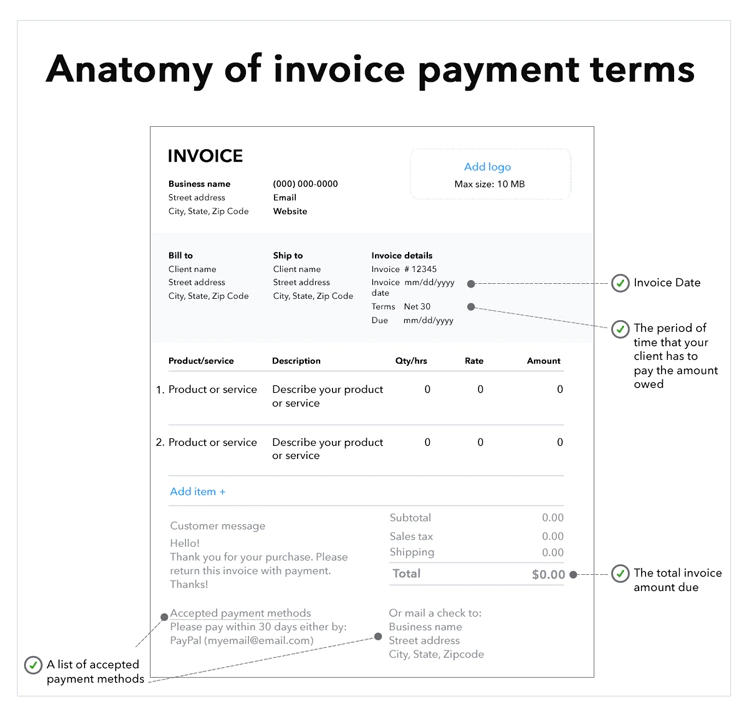

The following are common components of invoicing payment terms:

- An invoice date

- The total invoice amount due

- The payment date and period of time that your client has to pay the total amount owed

- Stipulations for an advance or deposit

- Payment plan details

- A list of accepted payment methods

You’ll also want to include a few more details on your invoice. You and the client will be able to trace bills chronologically if you include an invoice number. You should also provide your contact information. If a dispute arises, the client will know who to contact, and you will be able to rapidly settle the issue. You may also specify where the client should send the payment receipt.

Invoices with payment conditions specify when your business will be paid. Your invoicing system should be strategically beneficial to your business.

Standard payment terms

Let’s take a look at some of the most frequent payment terms that small company owners should keep in mind when creating invoices before diving deeper into payment terms.

- PIA: Payment in advance

- Net 7, 10, 15, 30, 60, or 90: Payment expected within 7, 10, 15, 30, 60, or 90 days after the invoice date

- EOM: End of month

- 21 MFI: 21st of the month following invoice date

- COD: Cash on delivery

- CND: Cash next delivery

- CBS: Cash before shipment

- CIA: Cash in advance

- CWO: Cash with order

- 1MD, 2MD: Monthly credit payment of a full month (or two-month) supply

- Stage payments: Set payments over a period of time, agreed upon by the client and seller

- Forward dating: Invoicing for payment to be made after the customer receives the order

- Accumulation discounts: Discounts on large orders

- Partial payment discount: When a seller offers a partial discount due to low cash flow

- Rebate: Refund sent to the buyer after they’ve made a purchase

- Contra: Payment from the client, offset by the cost of supplies purchased

Why are payment terms important?

Payment terms are critical because accurate cash flow estimates need knowing how much money is likely to touch your account and when.

QuickBooks discovered the following:

- 80 percent of small business owners are concerned about their financial flow.

- Late client payments are cited as the leading source of cash flow difficulties by more than half of small business owners.

- Sixty-two percent of small company owners have no idea how much money they get each month.

- Because they were worried about cash flow, 58 percent of small business owners said they made a bad business choice.

Accurate cash flow estimates to aid in tax planning, keeping your firm running smoothly, and managing its development. A concise, professional invoice can assist you in ensuring that your clients pay on time.

Example of how payment terms work

Consider the following scenario to better understand why payment terms are so important to your company’s finances:

Assume you’re about to launch a new business. You’ll need to spend $5,000 on new equipment. You got a huge order from a customer and sent an invoice for $7,000 to them. The customer is expected to pay the invoice by the end of the month, according to your estimates.

The consumer, on the other hand, does not pay on time. As a result, you won’t be able to buy the new equipment you require. You’re now paying rent for your storefront, despite the fact that you’re not doing any business there. As a result of the late payment, you begin to lose money.

This example highlights the importance of paying invoices on time. Creating a clear, easy-to-understand invoice will go a long way toward ensuring that you are paid on time. As a consequence, you’ll be able to keep your business running and achieve your growth objectives.

How to use payment terms

When establishing a contract, payment conditions are critical. Payment conditions should increase how fast your clients pay you while minimizing consumer annoyance. Both parties should profit from a fair set of payment conditions.

Remember to align your payment terms to your company goals when you begin invoicing customers. Choosing the right payment terms is a vital part of starting and running a successful business. Your payment terms should always be included on your invoices, but they should be discussed with your clients beforehand.

Prepayment

Customers might be required to pay for services in advance. Advance billing can help you increase your cash flow while also lowering your chance of losing money. For example, if you own a wedding photography business, you may wish to eliminate the possibility of cancellation. As a result, you can require your consumers to pay in full upfront. Customers who pay in full upfront may be eligible for discounts from some establishments.

50% upfront

You can receive 50% of the entire cost of a customer’s transaction as a partial payment. Part payments might help you get the operating capital you need to finish a customer’s project. They may also benefit your clients by allowing them to spread out their charges over a longer period of time. Smaller payments for your clients can also benefit your company, resulting in improved sales and order value.

When a consumer is unable or unwilling to pay in full upfront, a 50% deposit may be a compromise between businesses and customers. As a result, both parties are exposed to the same level of risk. If you go with these terms, make sure you specify when you’ll get the remaining 50%.

Installment agreements

You may also make partial payments via payment plans that divide your customer’s payments into smaller chunks. You might, for example, break the whole amount of the customer’s purchase into a series of smaller monthly installments. Installment agreements are comparable to line-of-credit payment arrangements, with the exception that they are paid in cash.

Some businesses break down large projects into milestones, with the consumer paying for each one separately. Installment agreements might be based on a set schedule—every three months, for example—or on the completion of a specific project component.

Lines of credit

Buyers who use line-of-credit payment conditions get credit for the items and services they buy. Customers can then return the balance according to the payment schedule that has been established. Offering credit to customers via your company carries some risk, as the consumer may default. This sort of client financing is mainly used by larger companies.

Immediate payment (payment due upon receipt)

The term “immediate payment” refers to a transaction in which payment is needed as soon as the goods or services are delivered. “Cash on delivery” (COD) and “payable upon receipt” are examples of quick payment arrangements. You can include into the contract that you have the right to repossess items if the consumer does not pay right away.

Net 7, 10, 15, 30, 60, or 90

The number of days till payment is due is referred to by these phrases. For example, Net 30 (or N/30) signifies that a customer must pay their invoice within 30 days of the invoice date. If you use Net 30 terms, and your invoice is dated March 9, your customers must pay by April 8.

As a business owner, choosing net payment terms may be inconvenient because you will have expensed the whole project without getting any revenue. Customers, on the other hand, may prefer these phrases. Find a time that is convenient for both you and your customer.

Subscriptions and retainers

Customers that pay by subscription or retainer must pay on a regular basis, such as monthly or yearly. Retainer agreements often require firms to provide bills to clients on a regular basis. Invoicing for regular payments can be automated.

Early payment

You may offer consumers a discount if they pay on time. Consider giving a 5% discount if the consumer pays the entire payment before the due date. It’s a win-win situation if you pay on time. Customers will save money on your goods or services, and you’ll have enough money to finish the project.

How to control payment methods with payment terms

You have control over not only the date of your payment but also how your consumers pay you. Include your payment alternatives in the conditions of your invoice. Setting expectations for your chosen payment methods can help you get paid and avoid any subsequent uncertainty.

Making the payment procedure as simple as possible for the consumer is the easiest method to outline your payment policy. You could be used to getting paper checks or cash, for example. Increasing the number of approved payment methods, on the other hand, will raise the chance of on-time payments. Smart invoicing and credit card payments are two of the more current payment options to consider.

Smart invoices

Customers may pay online at any time using software like QuickBooks’ pay-enabled smart invoicing. Customers can pay with credit cards, debit cards, and automated clearing house (ACH) bank transfers using smart invoicing.

You may also set up automated and regular payments, which can help with invoicing by removing the guesswork. If you don’t want to set up regular payments, you may send invoices to customers through email with a payment link. If you have continuing contracts, these features come in handy.

With a QuickBooks Cash business bank account, you may get a free email and ACH payment merchant service account, as well as free fast deposits.

Credit card payments

You might be able to take credit card payments as well. You have the option of requesting a credit card number from the client. Alternatively, you may take mobile payments using the QuickBooks GoPayment software, which comes with all of the required hardware to accept all major credit and debit cards using only your mobile smartphone.

Payments made with a credit card are subject to fees. Some company owners prefer to pay the costs out of their own pockets, while others choose to pass them on to their consumers. If you choose the latter option, make sure to specify it in your contract. If the consumer chooses this payment option, the contract should explicitly state that you will charge them a credit card fee.

Common payment term challenges among small businesses

In order to protect your firm financially, you must establish invoice payment terms, but this infrastructure comes with its own set of issues. Let’s look at some of the issues that might occur with invoice terms, as well as how to avoid them.

Payment security

Despite the fact that online payments are nearly ubiquitous in every buying experience, not all payment platforms are reliable.

Managing payments and tracking invoices

Managing payments and allocating cash to the right divisions within your firm may be tough depending on the size and structure of your company. What’s the solution? Create an invoicing system that includes clear payment conditions and efficient procedures.

Unpaid invoices

Unpaid invoices are unfortunately a typical problem for small firms. Setting up clear payment terms and late payment restrictions will assist ensure that all of your hard work pays off. While you have choices for dealing with outstanding payments, such as invoice factoring and sending past due payments to collections, excellent payment terms can help you avoid late payments.

So nothing falls between the cracks, QuickBooks makes it simple to invoice your customers, take payments, and generate follow-up reminders.

Tips for establishing effective payment terms

1. Define your terms in a contract

Before you start working, it’s critical to agree on payment terms with your consumer. Collaborate to establish the best course of action for both parties. Once you’ve reached an agreement, write out your conditions in your contract.

If your consumer does not pay on time, you will have legal standing if you document your conditions. If you don’t get paid quickly and your client ignores your past-due bills, you may need to take legal action to recover the monies. Because an invoice is not a legal document in and of itself, you will have no legal standing if you do not have a contract in place.

2. Invoice promptly for on-time payments

As soon as you finish order or provide a service, create and send an invoice. Payments may be delayed or cash flow may be disrupted as a result of delays. The basic financial foundation for your company’s activities is cash flow. Receiving fast payments from consumers helps you to concentrate on the day-to-day operations and growth of your firm.

You may create a professional invoice for your customer with our free invoice generator. To secure on-time payments, QuickBooks can help you optimize your invoicing process.

Key takeaways

Setting up an invoicing procedure with specific payment periods is critical for business accounting. Payment terms prioritize your payments and establish expectations for your consumers, resulting in more professional and productive client relationships.

Payment periods for invoices vary depending on how your firm runs, however, there are certain common elements:

- Invoice date

- Payment due

- Payment due date

- Payment options

- Payment process

- Miscellaneous stipulations (i.e., late payment penalties, early payment information, interest invoice)

You can simply connect with clients, set up payment arrangements, and recover accounts receivable using QuickBooks Online and QuickBooks Payments.